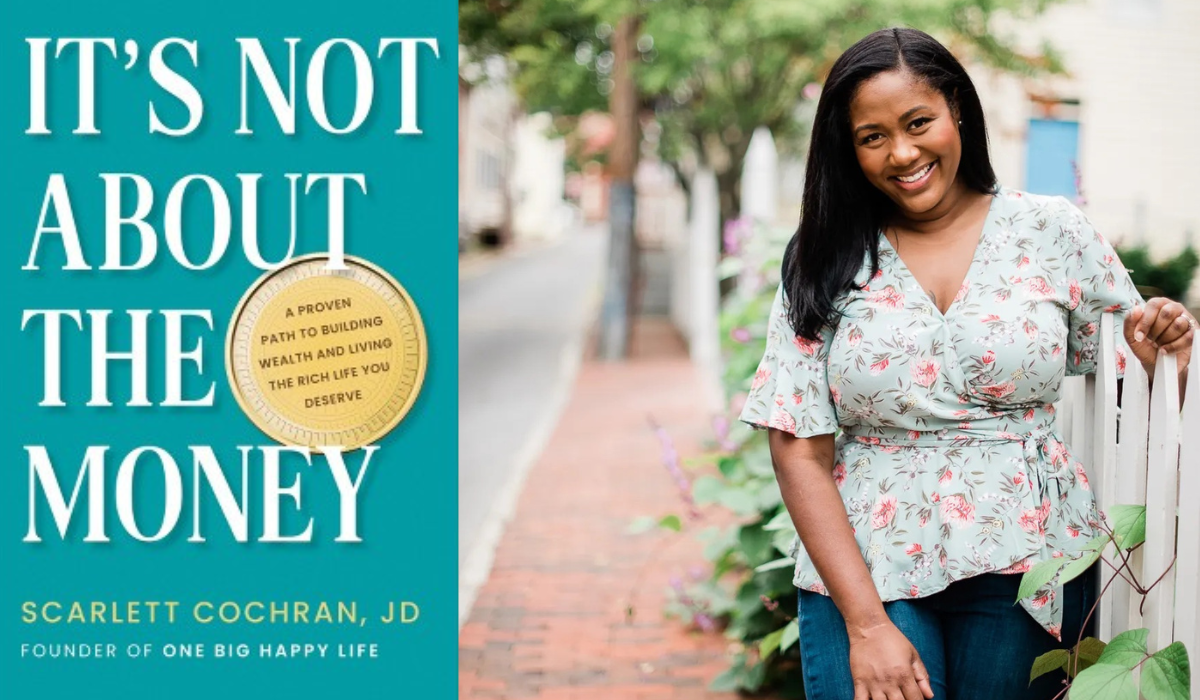

Money Is on Everyone's Minds these Days. This Financial Expert Has a Radical New Approach to Making Your Money Work for You

In her debut book, It’s Not About the Money: A Proven Path to Building Wealth and Living the Rich Life You Deserve, financial expert Scarlett Cochran doesn’t dish out any of the heady, unrelatable financial advice that often permeates money books. Quite the opposite. Cochran delivers her financial counsel with clarity and optimism that conjures hope and possibility. “I want people to believe that you can have the things that you want,” she tells The Sunday Paper.

Cochran is proof of her words. Since her time as a young mother living below the poverty line, she’s built a multi-six-figure nest egg while working her nine-to-five job. And while she’s garnered noteworthy credentials, including a Yale law degree, Cochran admits most of her money wisdom—some of which she shares with us here—is self-taught. “Not everyone’s financial priorities are, or should be, the same,” she writes.

We recently called Cochran to get her take on the old money rules to lose, plus where to start when we want to make our money work for us and toward our dreams.

A CONVERSATION WITH SCARLETT COCHRAN

You write that money has three purposes: joy, stability, and independence. Walk us through what this means and why it’s important.

We want our money to be working for us. Therefore, we want to always be thinking about these three essential purposes of money—the joy, the stability, and the independence. Those three things represent what we really want our money to do.

When it comes to stability, we want to be able to weather financial upheaval—the expected and unexpected things that happen in life. This can be illnesses, job losses, and unexpected things out of our control. We want to have a financial cushion so that when those things happen, and they will happen because they are an inevitable part of life, it doesn't throw us off course.

Along the way, we want to make sure that we're also spending for joy. We are never taught how to spend well in a way that allows us to enjoy our money. We're spending, but we're not getting the full satisfaction because we've never stopped to think, what do I actually most enjoy spending money on? When we think of this, we can start prioritizing our spending. You don’t have to deprive yourself. You can prioritize spending on the things that matter most while also allowing yourself to hit your other goals. This way it doesn't feel like deprivation. It feels purposeful and conscious. You’re doing it because you want to do it, not because you feel like you have to do it.

Then we know at some point we’re going to stop working—either because we will have to stop working or we will want to stop working. We want to make sure that we have the financial resources to support ourselves in the lifestyle we want later in life.

Certain financial advice, such as you must forgo little luxuries like lattes if you want to be responsible, has been drilled into our consciousness. What is some conventional money advice that we need to let go of?

#1: Budget percentages—putting certain percentages of your income toward certain living categories without thinking about the lifestyle that creates.

What happens with budget percentages is someone could follow these budget percentages and struggle against them because housing costs in New York City are different from housing costs in Charlotte. These are the generic budget percentages that we're all trying to keep our living expenses within even though we all live in different areas of the world, and we are all in different life stages. It just doesn't make sense. What makes more sense is people really setting budgets according to their own priorities. Some people want a house in the city, whereas other people want to live out in the country on a homestead and those budgets look different—and that makes sense. So budget percentages have to go.

#2: Depriving yourself of your lattes.

How this has come about is the way we’ve looked at money. We tend to look at the amount of money we make as if it's fixed and impossible to change. And so our only option is to budget in accordance with the money that we make. In reality, we all know that there are things that you can do to advance your career to grow your income if you decide that that is what you want to do.

Instead, it's important to decide what kind of lifestyle spending you want to have. Do you want to make sure to have the lattes in your budget while also building your emergency fund and investing for retirement? If the answer is yes, you create what I call your ‘ideal budget’—a simulation that shows you how much money you need to do that. Then you can set that as a goal for how much money you want to make in your career.

In the meantime, you can also decide that you prefer to spend more money on lattes, but less money on dinners. Maybe you're happy to cook dinner at home every day, but you want your latte from your favorite local coffee shop every morning. And that's all okay.

Considering how unique everyone’s financial situation is, what are a few healthy and universal money practices that we can all start today to help us work toward our goals?

Here are the two most important things for people to do:

#1: Start paying attention to where your money is going. For 30 days, write down what you're spending your money on without judgment. Jot your spending down and reflect on it. Then give it a rating from one to 10 based on how happy you are with what you got for your money.

Doing this will allow you to start becoming more aware of how you’re spending your money, and it will help you be more intentional. Because we all have a habit when we're doing a mental money map of thinking that we're spending less than we are. So having that level of awareness will empower you to start making different decisions with your money going forward. Your spending will be aligned with what you want to be spending your money on versus your current default spending.

#2: Look at the minimum investing rate. This is the amount of money that you need to invest every month to hit your financial independence number (or financial freedom number, the amount of money you’ll need to sustain your preferred lifestyle when you stop working). Working toward this should be most people's number one goal. The minimum investing rate is designed so that as long as you hit that, you will then have enough money to cover your lifestyle expenses. Whatever they are for the rest of your life. That is a cornerstone financial habit: investing for your future.

Money can be so stressful. And plus, it’s on all of our minds. What do you ultimately hope readers take away from your book and your lessons?

My hope is that they will start dreaming again. That they will start dreaming bigger for their lives, dreaming bigger than they ever thought possible. I believe that having that big dream, that feeling of what you want to be when you grow up that you had as a child, and going back to that feeling over and over as an adult, will really change the trajectory of your money and your life.

Scarlett Cochran, JD is an attorney, financial expert, and entrepreneur. In her career as a lawyer, she worked on behalf of everyday Americans at government agencies, including the Consumer Financial Protection Bureau, the Federal Deposit Insurance Corporation, and the US Department of Housing and Urban Development. She has also served her country with the Marine Corps. You can learn more at onebighappylife.com and order her book It’s Not About the Money HERE

Question from the Editor: What is an old piece of money advice you'd like to let go of? We'd love to know in the conversation below!

Please note that we may receive affiliate commissions from the sales of linked products.